| Gold News & Press Comments

Gold Options @ $1,000 to $2,500

Punters bet on gold at $US1000/oz

July 17, 2006 LONDON: A sudden surge in demand for gold options cashable at over $US1000 an ounce is the clearest sign so far that hedge funds and traders are betting on a big rise in bullion prices.

UBS said investors had begun to show interest in "call" options to expire in December with strike prices of $US1000 ($1326) an ounce and above. UBS precious metals strategist John Reade said: "Some options traders are positioning themselves for very large moves higher."

The prices are far above gold's all-time high of $US850 at the height of the oil and inflation crisis in 1980. Gold closed on Friday at $US664.15 an ounce.

Buying a call option gives investors the right to buy a quantity of metal (or shares or other instruments) at a fixed price on a set date. If the price falls short, the option expires worthless. If it shoots above the strike level, traders can make huge multiples on their stake.

Telegraph, London

A Good Case for Buying Gold?

It looks to us that many of the predictions forecast in Wake Up

are now happening. Lowest Recent Gold Price

Bull Market?

Does the drop after this price peak mean an end to the gold bull market, we believe not, more of a correction.

|

|

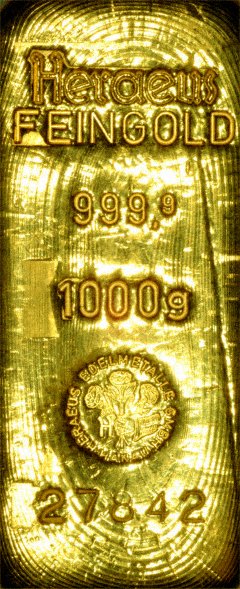

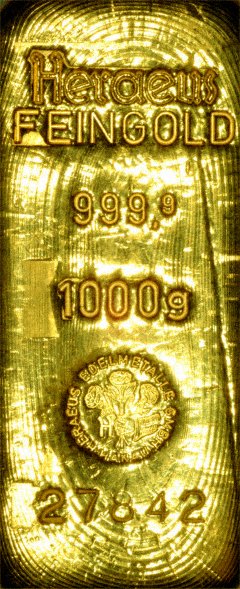

One Kilo Gold Bar

Gold News & Comments

Bullion Coin Selector Page

|